Blog

Do your VCs have an uncomfortably high burn rate?

Nov 02, 2014

* This blog is a follow-up to Fortune’s Dan Primack and his post: "The startup world's other 'cash burn' problem” where he suggests that venture capitalists, by and large, have a burn rate problem.

Over the past several weeks, much attention has been placed on unquestionably high start-up burn rates and whether entrepreneurs should change their current operating models in the face of a potential downturn. But an equally important question for entrepreneurs is whether the VC industry, and specifically the firms that have invested in YOUR start-up, have an uncomfortably high burn rate. Have we invested too quickly in other start-ups and have alarmingly low cash reserves? Have we prepared for a downturn?

For many entrepreneurs, the idea that a VC firm could run out of money feels highly unlikely. But VC firms have their own “burn rate”—they do not have unlimited capital and must manage their investable cash between new investments and reserves for follow-on investments. The rule of thumb is that VC firms should reserve about $1 for every $1 invested in a portfolio company. In good times, when capital from a variety of sources including hedge funds, mutual funds, and wealthy individuals chases after start-ups, VC firms tend to reserve a little less as they can rely on alternative sources of funding. When the cycle turns, these alternative sources tend to exit the industry, leaving only “traditional” VCs who have the appetite, conviction, and CAPACITY to continue investing. VC fund reserves enable the industry to fund its best companies during tough times; within NEA’s own portfolio, some of our biggest wins—companies like Groupon, Opower, Tableau Software, and Workday were supported through some of the darkest days of venture capital between 2008 and 2010.

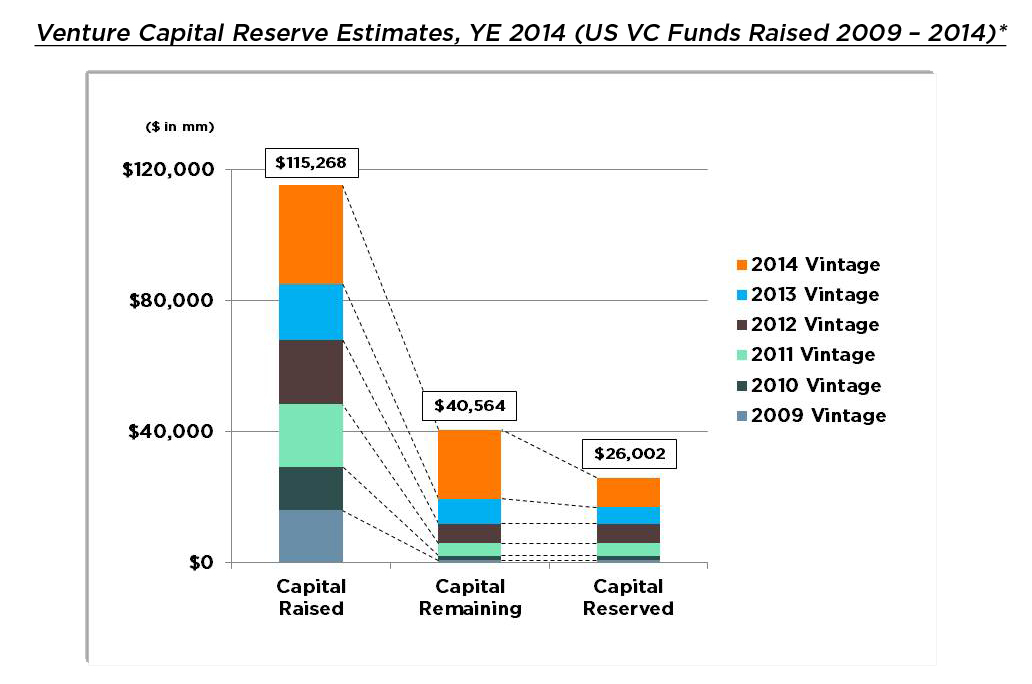

Is the venture industry prepared for a downturn? The following chart shows how much capital has been raised in the US venture industry over the past 5-plus years—over $100 billion since 2009. It is very hard to know exactly how much has been invested by each individual firm, but it is possible to estimate how rapidly funds have deployed their capital over the past 5 years, and how much capital is reserved for a rainy day. Most funds commit their capital over a 3-5 year investment period, with the vast majority of new investments made in the first 3 years and the remainder of the funds “reserved” for follow-on investments in that fund over the subsequent 5-7 years. Using a set of assumptions* to gauge how fast each fund invests their capital, we can estimate how much capital is reserved across the industry. Based on the chart below, our best guess is that the industry will have ~$40 billion of available capital and ~$26 billion of capital earmarked for reserves at the end of this year.

This may seem like a lot of money in aggregate, but for many entrepreneurs that have never experienced a severe downturn (when all of the non-traditional sources of venture capital flee the market), there are a few warnings:

Venture backed companies (from all sources) are raising ~$10 billion PER QUARTER. If the VC industry alone were to attempt to fund all current VC backed companies at today’s levels through a downturn, we would effectively run out of reserves in 3-4 quarters. It is obvious that the industry investment pace would have to slow down dramatically, at least 30-50% from current levels, in order to extend the runway of our reserves through the cycle.

The ~$26-40 billion in capital that is reserved must be shared across thousands of companies that have received >$160 billion in venture financings between 2009 and 2014. That’s ~$0.16-0.25 of reserves for every $1 dollar invested in venture capital per company. Under certain extraordinary circumstances, even the top quartile of VC funded companies will be fighting for their fair share.

Though the above numbers may be alarming in aggregate, the good news is that many VC firms are resilient and prepared for times like these. Some firms, like NEA, take a very conservative approach to creating reserves to ensure that we always have cash for our portfolio companies. In addition, the industry has established many tools to extend cash runway, including fund recycling (investing profits from old investments into strong existing portfolio companies), and both formal and informal co-investment vehicles with LPs that can create more capacity for much needed capital. These approaches are not universally employed, but they can mitigate the effects of a downturn and provide a boost to the industry’s reserve capacity to help companies through tough times.

Our industry is nearly 50 years old, and has largely survived several economic downturns while keeping our best companies alive. As an entrepreneur, it is tempting to be lured into a false sense of security or paranoia by knowing whether your existing investors can fund you through the next economic cycle. Great companies find a way to attract capital no matter how difficult the financing environment, and average companies won’t survive a downturn, no matter how well capitalized or strong their VC syndicates. As VC’s and entrepreneurs, we must cherish the capital we have been given, invest it wisely and efficiently, and together build great companies that can last. This is the best way to survive a downturn, and ensure that together we can weather a storm.

* The industry “burn rate” is calculated by measuring the % of VC funds that are deployed in any given year, based on their vintage year. For purposes of this analysis, we included all NVCA / Moneytree US VC funds closed since 2009 and have modeled deployment of each fund such that ~70% of every fund is invested over 3 years, and ~30% is reserved over the following 5 years. “Capital Remaining” includes capital for both new investments and reserves for follow-ons. “Capital Reserved” includes only capital specifically earmarked for reserves after initial investments are made. For more detail, please e-mail jsakoda@nea.com.

Jon’s perspectives on VC and entrepreneurship can be found at www.jonsakoda.com or on Twitter @jonsakoda.