Blog

Synthesia: AI to Empower Video Generation for the Enterprise

by Philip Chopin and Luke PappasJan 15, 2025

“Generative AI will enable every company to become a video-first organization.”

From Vision to Reality: Synthesia’s AI Bet Pays Off

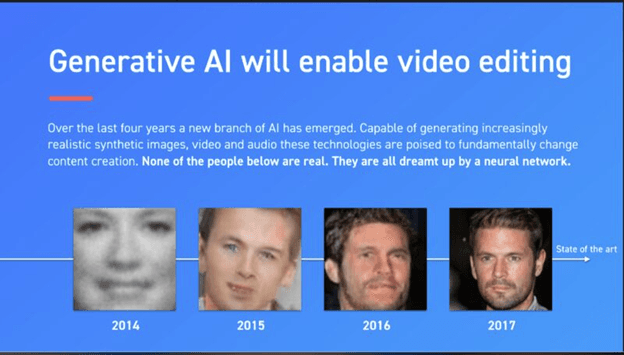

Before AI had come into the mainstream, back in 2017 when Synthesia was just starting—Victor Riparbelli and Steffen Tjerrild were already ahead of the AI curve, envisioning how AI would revolutionize video.

Today, it is safe to say that their prediction from an old Synthesia slide deck about generative AI’s impact on video editing has proven to be true. Generative AI has undoubtedly impacted many creative areas—from text, image, and now video—and we view Synthesia as being a leader in driving the advancements of this technology.

Synthesia’s Evolution: From AI Avatars to Enterprise OS

Fast-forward to the past 7+ years, and Synthesia has grown from the leader in AI avatar technology, to now becoming the category leader in enterprise video communications [1]. With Synthesia’s proprietary models, users can train a digital twin of themselves that can then be featured in videos. Beyond AI avatars, the broader Synthesia platform serves as an end-to-end operating system for enterprise video, enabling teams to write a script and create a custom video, collaborate with their colleagues to edit it, and then distribute it to their audience—reducing the video production timeline by as much as 95%. Synthesia makes every step of the video production process easy and intuitive: customers are able to share content they have created on the platform, give or receive feedback, edit that content seamlessly and quickly, and then publish it in dozens of different languages, all within a central platform.

Why We Backed Synthesia: NEA’s Investment

When we first opened our London office a few years ago, Synthesia was at the top of our dream list of companies that we would love to eventually partner with. So, when the Series D opportunity arose late last year, we dropped everything and ran as quickly as we could. Today, we are happy to announce that we are leading Synthesia’s latest investment round. This will be our largest single check in our European portfolio to date, a sign of the strong conviction that we have in the Synthesia team, and the opportunity ahead. Underlying this conviction is our investment thesis, which is rooted in a few core points:

1. First, we believe in the future of video as a medium of communication in the enterprise. Video is much more expressive than text or image. For argument's sake, imagine you get this text from your manager at work: “Hey, let’s get lunch.” Without any additional context, you might be left with a lot of questions. Is my manager happy or upset? Am I about to get asked to come in this weekend? Or maybe a new promotion? Or is this just a casual catch up? A video message, on the other hand, conveys much greater context, but historically, the limiting factor has been the time it takes to create. As another example, let's assume you are a sales rep working to land a major new client. To win the account, you plan to send a recorded video of your closing pitch. You write the script and then spend hours re-recording as you make changes to the script and edit the video. Ultimately, the video pitch is well received, but you spent the entire week making it, forgoing the chance to land new leads outside of this one account. In each example, video is the better option because it conveys more information, but the limiting factor is the time it takes to produce these videos.

This is where the power of Synthesia comes into focus. Unlike other enterprise video products like Loom and Zoom, which require live recording, Synthesia can take any text and turn it into a video, complete with emotive capabilities of your own personal avatar. For example, we made the following video invitation in Synthesia. This video was entirely generated within Synthesia, and total production time was 90 minutes—30 minutes to write the script that the avatar delivers, and an hour to edit the different scene backgrounds.

(Side note, the NEA team has jokingly said they prefer Synthesia Luke to real Luke!)

2. Next, we believe Synthesia has built a top tier product that users love. This has been evidenced in speaking to customers and reading reviews of Synthesia’s product. More than 60,000 customers use Synthesia, ranging from the world’s largest brands (60% of the Fortune 100 are Synthesia customers [1]) to thousands of small businesses. Product feedback is overwhelmingly positive and the company consistently scores 4.5 stars and above on average across G2, Gartner, Capterra and Trustpilot where there are over 2,900 public reviews. This is incredibly rare for an enterprise company of Synthesia’s size.

-1736902843.png&w=3840&q=75)

3. We also believe that Synthesia will continue to differentiate within the enterprise with the company’s focus on responsible AI and security. While the rise of AI applications has the potential for enormous positive impact, it also represents new threat vectors around data security, privacy, and protection that enterprises must account for. Synthesia is dedicated to robust security and compliance, recognizing that such measures are critical to gaining the trust of enterprise clients. Synthesia is the only AI powered video platform in the market to have achieved key certifications and implemented industry-standard security protocols including SOC2, GDPR, ISO 42001 and SAML 2.0 SSO Support. These measures are supported by a comprehensive ethics and safety framework that the company maintains internally.

4. But above all else, what gives us the most confidence in Synthesia is the team running the company. We find them to be truly world-class. Co-founders Victor and Steffen have the rare combination of being visionaries with infectious enthusiasm, while maintaining a rooted and practical view of the day-to-day. This is a dream combination of qualities for an entrepreneur, where each day you are creating the future while managing the operational realities of a physical organization. And with any highly functioning organization, best-in-class talent attracts other best-in-class talent. This is certainly true of the extended Synthesia team, and we could not be more excited for Synthesia to welcome Peter Hill as Chief Technology Officer in conjunction with the announcement of this round.

Synthesia, Responsible AI, and NEA’s Perspective

Over the past five decades of technology investing, NEA has been fortunate to witness several step function changes within the sector: the birth of the connected web, the emergence of mobile, the rise of consumer social, and the age of SaaS are examples of some of these paradigm shifts. We strongly believe that responsible AI will represent another one of these paradigm shifts, and we have been enthusiastically investing in this wave, partnering with companies like: Perplexity, Sana Labs, Uniphore, World Labs, VAST Data, and many others. We could not be more excited about our partnership with Synthesia, and furthering our commitment to investing in this age of responsible AI.

Notes & Sources

Disclaimer

The information provided in this blog post is for educational and informational purposes only and is not intended to be investment advice, or recommendation, or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by NEA or any other NEA entity. New Enterprise Associates (NEA) is a registered investment adviser with the Securities and Exchange Commission (SEC). However, nothing in this post should be interpreted to suggest that the SEC has endorsed or approved the contents of this post. NEA has no obligation to update, modify, or amend the contents of this post nor to notify readers in the event that any information, opinion, forecast or estimate changes or subsequently becomes inaccurate or outdated. In addition, certain information contained herein has been obtained from third-party sources and has not been independently verified by NEA. Any statements made by founders, investors, portfolio companies, or others in the post or on other third-party websites referencing this post are their own, and are not intended to be an endorsement of the investment advisory services offered by NEA.

NEA makes no assurance that investment results obtained historically can be obtained in the future, or that any investments managed by NEA will be profitable. To the extent the content in this post discusses hypotheticals, projections, or forecasts to illustrate a view, such views may not have been verified or adopted by NEA, nor has NEA tested the validity of the assumptions that underlie such opinions. Readers of the information contained herein should consult their own legal, tax, and financial advisers because the contents are not intended by NEA to be used as part of the investment decision making process related to any investment managed by NEA.